Many think that buying a home consists of saving for the downpayment and closing costs. However, there is much more you need to budget and account for to make a smart purchase.

Here are a few tips to help you plan:

- The debt-to-income ratio is very important when shopping for a loan. What is it? It’s your monthly debt payment divided by your gross monthly income. The less debt you have the better the loan.

- TIP: Try to get pre-approved prior to your search. Your MLO (mortgage loan officer) can assist you on how to reduce this number.

- A down payment is important but the type of loan usually dictates how much you need.

- TIPS:

- 20% down payment will not require you to have PMI (private mortgage insurance) which would be an additional monthly payment with the mortgage

- For every $1000 down payment, your mortgage usually only reduces by $6/month

- TIPS:

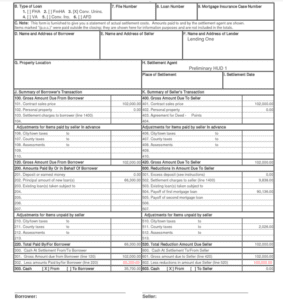

- Closing costs can be estimated between 2 and 5 percent. Once you are pre-approved and you know your target purchase price you will have a better idea.

- TIPS:

- Request a pre-closing statement and negotiate the fees that state “services you can shop for”

- Before you place a contract on a home, you can request closing costs from the seller. A good realtor can guide you here.

- TIPS:

- Home inspection costs are a necessary evil when buying a home. The standard 4-point inspection will usually only run you approximately $150 but you do not want to skimp out on this.

- TIP:

- Spend a little more money to have the home completely inspected to avoid a larger expense once you purchase the home

- TIP:

- Property taxes and homeowners insurance are added monthly expenses and most loans will require payment to be made into an escrow account.

- TIPS:

- You can shop out your homeowner’s insurance even if your MLO or bank offers your options

- Property taxes will be reassessed when the sale of the home is complete. To estimate, multiply the purchase price by about 2% or the average county tax rate.

- TIPS:

With these tips and an MLO and real estate agent you could be in your new home sooner than you think.